Leadership perceptions of Australian supermarkets have been strong for a number of years, with Australian Leadership Index data showing that the community valued this industry’s support and dedication throughout the COVID pandemic. While many other industries shut down or continued work remotely, supermarkets remained open and were busier than ever, delicately managing panic buying, staff shortages and COVID protocols. As the pandemic eased in Australia, an appreciative afterglow remained in place for the supermarket and grocery industry, the public thankful for their contributions to society. This afterglow has now dissipated.

Several inquiries are underway in Australia with both major supermarkets, Coles and Woolworths, set to be hauled before the Australian Senate, Australian Competition and Consumer Commission (ACCC) and a number of additional state and federal bodies. Each will investigate allegations of price gouging and the outsized power of Australia’s grocery duopoly.

One of the first published reports into this space, commissioned by the Australian Council of Trade Unions (ACTU), found that a lack of competition is a major cause of unfair pricing practices, with supermarkets, banks and energy companies using their market power and exploitative practices to push inflation higher. As these inquiries and investigations play out, it seems likely that similar results will be revealed, with a lack of pricing transparency both hurting customers at the till and the once-strong leadership perceptions of the supermarket industry.

Untrustworthy And Lacking Integrity At The Till

Recent data from the Roy Morgan Risk Monitor paints a troubling picture for Australia’s major supermarkets. Coles, once occupying the prestigious position of Australia’s fifth most trusted brand in Roy Morgan’s survey data, now find themselves being listed as the ninth most distrusted brand. Woolworths, while not suffering quite as a dramatic drop, still slid 32 places from its December 2023 ranking as Australia’s second most trusted brand to the nation’s 34th most trusted brand in March.

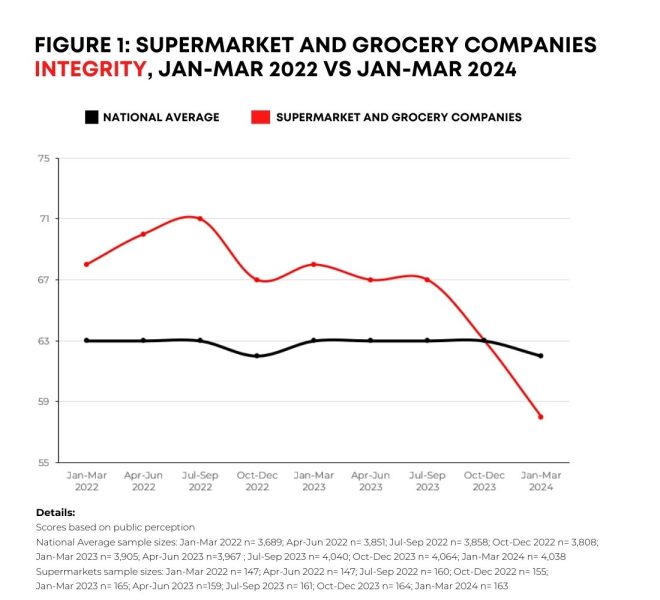

This is echoed by our Australian Leadership Index data, which shows a dramatic drop in perceptions of integrity for the supermarket and grocery industry over the past 24 months. As seen in Figure 1 below, perceptions of integrity for this institution have dropped 13 points since Jul-Sep 2022, now sitting four points below our national average for all institutions:

Over that time, both major supermarket chains have posted record profits, with Coles and Woolworths delivering $1.1bn and $1.6bn profits in the previous financial year. This occurred while Australians are paying record grocery prices, rising 7.5% a year and outstripping inflation by 1.5%. As the public grapples with the realities of inflation and economic strain, the discrepancy between their household budgets and the profitability of supermarket giants has sparked discontent and raised fundamental questions about the integrity of these major supermarket providers.

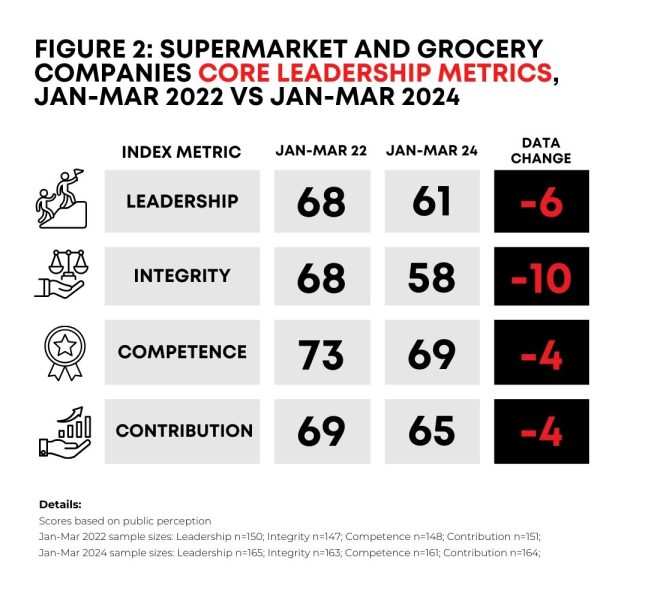

This has been the core driver in a drop in perceptions of overall leadership, as seen in Figure 2 below. While our data shows perceptions of competence and contribution have slid in the same time period, the fall has not been as dramatic. A lack of transparency and honesty from our supermarket industry has clearly affected perceptions of leadership in our survey data, with the public displeased with how this institution has been operating over the past 12 months.

These results are likely to get worse in the next quarter of data, as these inquiries proceed and their recommendations are published. There have already been calls to break up this major supermarket duopoly after the recent Senate inquiry into the issue, which would create headaches not only for the organisations themselves but the staff that work for them and the consumers that frequent each grocery provider.

This could affect perceptions of competence and further weaken perceptions of leadership. This industry needs to take real action if they are to win back public support, but whether they are capable of taking that action without further government intervention remains to be seen.

Ditch Loyalty Schemes And Show Loyalty To The Public

Both Coles and Woolworths have their own branded loyalty schemes that reward customers for shopping regularly at their affiliated businesses, Coles with their famous ‘FlyBuys’ program and Woolworths with their ‘Woolworths Rewards’ program. These items are yet another item under scrutiny by the government; a small part of higher prices in the final receipt for customers. For the major supermarket chains to win back customer support, they will need to demonstrate more than token loyalty to Australians.

There are likely a number of regulations to come into place that will attempt to address price gouging and the overall prices that these chains are paying to their suppliers, only adding to the pressures these organisations will feel over the coming months. Ultimately, a strategic shift in the mindset of our major supermarket providers is needed, particularly if they want their organisations to remain intact. Should they continue to operate without the integrity expected by Australians, it is likely that regulatory bodies will order the breakup of one or both of these powerful supermarket chains, along with providing more support for international and independent supermarket providers.

Operating with self-initiated, rather than externally imposed, transparency and integrity may be the only avenues left for Coles and Woolworths to win back public support and prevent further government interventions into how they operate. Protecting their own interests cannot continue to be their primary focus. Both organisations love to spruik their community initiatives and market themselves as family friendly. For many Australians, it is high time for them to take action in this space and do more to support those struggling with tough economic conditions.